Now, you understand what activities a company usually considers as revenue and where you can find these details. Let's dig a bit deeper into this issue from an analytical mindset. How is it that studying this will help us? If you recall in our previous blog on Presentation and Calculation of revenue, we discussed factors one should keep in mind before analysing Net Operating revenue. We mentioned two reasons among a few others, Revenue Recognition policy changes and Accounting Standard changes. Let’s understand each of these in detail.

Revenue Recognition policy changes case study: Kaveri Seeds

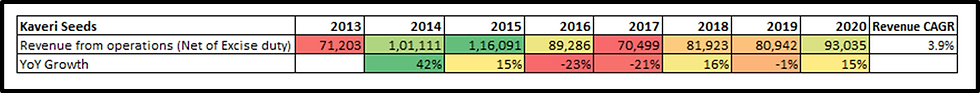

Kaveri Seeds is a Indian Listed Company which is into research, production, processing and marketing of various high quality hybrid seeds. If we take a look at last 7 years figures of the company’s reported Operating Revenues, we see a huge drop in turnover for 2016 and 2017, almost 23% and 21% Year on Year respectively (YoY - computed as (current year figure/ previous year figure) -1 ).

FY16 was a difficult year for Kaveri Seeds owing to poor cotton acreage (cotton farming) owing to really unattractive cotton prices set by Maharashtra Govt and two consecutive years of really bad Drought season. Below is a screenshot of the Chairman's message from Annual Report FY 2016.

However, things improved slightly in FY17 owing to the good monsoon season and yet Revenue figures seems to have dropped almost by 21%!

To understand why this has happened, Let’s take a look at the Revenue recognition policies of FY16 and FY17. Below are the screenshot and comparisons of the same. Notice the difference?

Yes!, till FY16, Revenue was net of just sales returns and taxes, but FY17 onwards, the company started reporting it net of trade discounts, and sale schemes discounts.

In Kaveri Seed’s line of business, dealer discounts or scheme discounts are a great way of driving sales by keeping dealers motivated (Almost 10-20%). As a result, sales schemes/ discount numbers are huge!

Hence a corresponding drop in FY17 numbers, as they are reported Net of discounts and FY16 and prior revenue figures were reported Gross (including discount) .

Note “Correlation doesn't imply Causation'': Just because there has been a huge change in Revenue figures, does not imply there’s always something wrong with/ change in revenue recognition policy or Accounting standards, it's just one of the checkpoints which we are trying to cover through this reading which an analyst should definitely look into. We will keep adding more such checkpoints to develop a complete analytical mindset of a true Financial Analyst. Continuing…

So, if someone were to simply calculate Revenue growth rate of the last 7 years, it would be just a CAGR of 3.9% (Calculations of this will be converted shortly below). Would it be right though? NO! Since half of the past 7 year figures are Gross Revenue figures and the remaining half are Net ! with the difference being almost over 10% every year!

So, what should an analyst do in this case? Make them comparable! There are two ways to do this, either make all figures gross or all figures net. Both methods are fine, however, since the numbers going forward will be reported on a Net Basis, the only choice we have is to adjust historical gross figures to Net figures! (Since we won't be getting sales schemes discount figures going forward as the number reported would be net of it. One may hope to find them in footnotes, but they aren’t present, we have tried:) )

Let’s see how to make all Revenue figures Net of sales scheme discount! Simple, find the sales scheme discount figures in the expenses footnotes and net it out of Gross reported revenues! We have done this analysis for your understanding below:

Note: As one can observe, the Sales Scheme discounts as a % of revenue are calculated as Sales Schemes figure/ Revenue for the year. This % ranged from 13%-20% which happens to be huge. However, this figure won't be available going forward as the revenue figures are being reported on a net basis. Considering its a huge cost to the firm, an analyst should always track such numbers, even if they are not being explicitly disclosed, one can ask for guidance for the same in conference call discussions.

Also, for the CAGR calculation, we have used the RATE formula in excel, which takes in present value (beginning value) and ending value (Final value) to compute the growth rate during the time frame. In the above image, we have calculated 7 years (2014 to 2020) CAGR by taking the year end value of 2013 as the beginning value of 2014. Hence the number of years is 7 and not 8!

Also, to confirm if our understanding is correct, FY17 onwards, we wouldn't expect any Sales scheme discount numbers under the same expenses footnote where it used to be disclosed earlier as now, it would be netted out of Revenues. And our understanding is verified by the same!, one cant find it under expenses anymore.

Moreover, we further verified our understanding from the concall discussion by the management too!

Now, if we take a look at the revenue growth rates, we would see a huge difference in the CAGR! (6.4% Vs 3.9%) This is precisely what we were talking about earlier, when we said not to directly take the company reported numbers, but to understand them first before using them at your disposal.

Unfortunately, the art of data punching is highly underrated and data vendors are overrated in today’s financial world as it saves time, and given the materiality and probability of such error rates are very much minimal, it ends up being the only choice. However, like we mentioned earlier, what we want to deliver through this content is for an analyst to gather ground level understanding of data which happens only when data punching is done manually rather than sourcing figures from secondary sources.