Revenue is income/ sales/ turnover of a company, generated from its business operations during the year. It’s the topline of the company (also known as Total Income) which drives profit after deducting all the expenses. Companies earn revenue in return for the supply of goods/ services. It's the only sustainable source for the company to generate cash to fuel the growth & survival of the business.

The most common technique at which the companies are valued is the discounted value of their future earnings (Present value of future cash flow - this will be covered in much detail in Valuations blogs). Since revenue drives earnings, earnings drive valuations (among other factors). Thus, understanding Revenue figures and its drivers is very important as whole business and valuation analysis is dependent on revenue among a few other factors.

To understand revenue figures, we need to understand

Presentation & Calculation of Revenue Figures in Financial Statements (Blog 101 and Blog 102)

Various ways of what is Defined as Revenue by a Company (Blog 103)

Sources of Revenue Generation & Analytical aspects around Revenue Numbers (Blog 104)

Let's take it step by step. In this blog we will be focusing on Presentation & Calculation of Revenue Figures in Financial Statements.

Revenue figures can be sourced from the consolidated Income statement (for the entire company, its subsidiaries/ associates as a group) or even from standalone Income statement (for the individual parent company).

When to use standalone or consolidated figures will be discussed in much detail in the Consolidated Vs Standalone figures blog post. But for now, we are going to stick to Consolidated figures only.

Below is a screenshot of the presentation of Revenue figures in the Consolidated Income statement for Hindustan Unilever Limited.

Source: HUL AR-21 (Consolidated Income Statement)

The presentations can also vary across different industries. Across the Banking industry, you would find it presented in a very different format and labels, example below. This will be discussed in much more detail in the Banking Sector blog post.

Banking Companies Revenue Presentation

Source: ICICI Bank AR-21 (Consolidated Income Statement)

Anyways, moving back to HUL case, Notice there are two line items summing up to Total income:

Revenue from Operations and Other Income. 47,028 + 410 = 47,438 Cr. (INR).

Let’s understand what both these items are.

1) Revenue from Operations: It's basically income generated from the company's core business operations. We can open the footnote number adjacent to the revenue figure in HUL income statement i.e. footnote no 24. This will show a detailed breakup of what the company considers Revenue from Operations i.e. what sums up to the amount of 47,028 Crores.

Source: HUL AR-21 (FootNote/ Notes to accounts for Revenue Figure)

Within the Company’s reported Revenue from Operations are:

a) Sale of Products - Clearly related to business Operations,

b) Sale of services and - Clearly related to business Operations

c) Other Operating Revenue - Scrap sales, export incentives, etc.

Let’s dig even deeper to understand how these categories are computed.

a) Sale of product or b) Sale of services, is usually calculated as

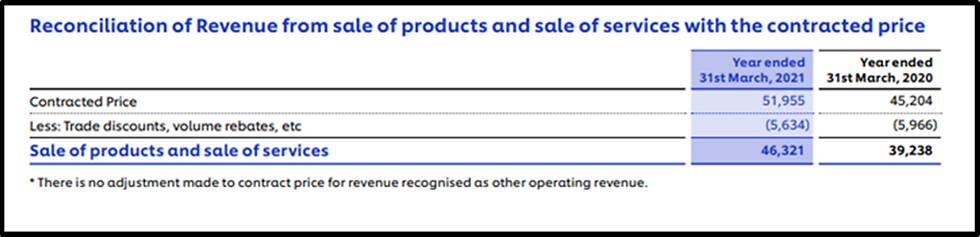

Revenue from Operations/ Net Revenue = Sales price (Contract price) - Trade discounts/ volume rebates - Sales returns - Taxes/ Duties

Sales Price/ Contract price - Price at which the good/ service is sold/ rendered respectively

Trade discounts - discount offered to retail customers

Volume Rebates - discount offered to customers for buying in bulk volumes

Cash discount - discount offered to customers, if they pay advance/ full cash payment on invoice date for the entire goods bought/ services availed.

Source: HUL AR-2021

Note: Sales returns are a very important datapoint to track while analysing Revenues, however for time being, we won't be discussing this as we are yet to take you through analysis of Inventory and COGS, when we do that, you would have a much better understanding of Sales returns and how to analyse and track them.

Under new Accounting standards, it is mandatory for firms to disclose a breakup and computation of Revenue from Contract price. In the below screenshot, you will notice that Revenue of Sale of products and services is 46,321 Crores which is the same as sum of Sale of product and sale of services from note number 24. (46269 + 52 = 46,321)

Source: HUL AR-21 (Contracted price footnote)

c) Other Operating revenue - Generally below line items are included as part of Other Operating revenue of any business and here’s why:

Export Incentive: Export incentives are generally offered by Governments to encourage industries to export their products or services globally/ to a selected region/ country. These incentives are generated only on the back of a company's operations, hence it should be a part of operating revenue.

Claims Received: A claim is an official request as part of insurance or other legal claims for payment which company demands for the goods which are usually damaged

Sales tax incentives: Same logic as Export incentive.

Interest subsidy: Interest subsidy amount is what the government is offering to incentivise the borrowers for conducting their operations, which is why it should also fall under operating revenue. For example: Interest Subsidy for MSME Units in Gujarat: Through this scheme, an interest subsidy of up to 7% for micro-enterprises and 5% for small and medium enterprises is provided.

2) Other Income: Now that we completely understand the computation of Revenue from Operations, Let’s take a look at what falls under the Other Income item on the Income statement from its footnote 25.

Source: HUL AR-21 (Footnote Other Income)

Interest Income: is classified as Other Income (i.e. Non Operating Income) unless you are in the Banking industry and its core business.

Dividend Income: is classified as Non Operating Income unless you are a holding company i.e. its your business to invest shareholder’s money in some other companies and grow them.

Sometimes, you may also find hedging gains or foreign exchange gains as part of Other operating revenue, you will understand them in much more detail in our hedging blog post. FVTPL (Fair value through Profit and Loss statement) is something which will be covered in much detail in the Investments blog post. Meanwhile, take it to be a non Operating Income.

Now that we understand how companies present and calculate revenue figures, the question is, should we take their reported Operating revenue as Revenue for our analysis? Answer is No.

Please read our next blog,102 - Understanding Presentation & Calculation of Revenue Figures in Financial Statements Part 2, to understand the adjustment that needs to be done to make revenue numbers useful for analysis.