After Knowing characteristics of a good business/industry (please Read Part 1 here before you proceed reading this article) now let us filter out Industries and Companies which fulfills these characteristics.

We simply run query on screener where we have inserted 3 filters which are:

Sales growth last 10 years > 10%

Average ROCE of 10 years > 15% and

Market capitalization > 500 crores because we wanted to avoid small companies in that list.

Only 197 companies out of 4789 (No. of companies with listed equity capital on BSE as on 23-Feb-2022) have been able to generate this kind of normal profit.

List as on 23-Feb-2022:

Now you would be thinking why we have written normal profit, so the answer to that question would be if Nifty-50 is giving after tax 12.5% CAGR (ax explained in part 1 here) with diversification benefits an individual business should at least earn 2-3% higher than 12.5%.

To only talk about outstanding businesses, businesses which has generated huge alpha in the long term, we decided to filter companies taking an average 10 years ROCE of 20%. Hence, the filter became

Sales growth last 10 years > 10%

Average ROCE of 10 years > 20% and

Market capitalization > 500 crores because we wanted to avoid small companies in that list.

Only 123 companies came under this filter. The list reduced from 197 companies to 123 companies.

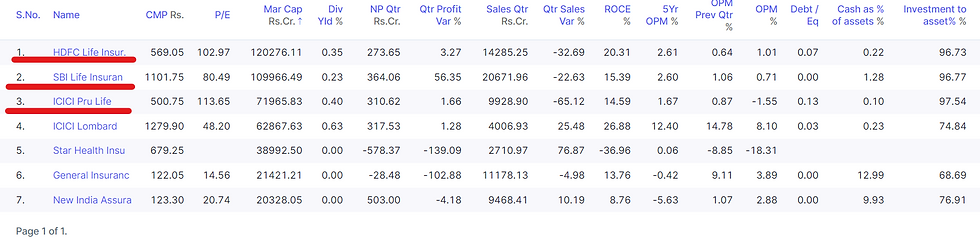

List as on 23-Feb-2022:

The MOST interesting insight was the pattern of return distribution - It’s clustered around a few industries.

Almost 57% of companies from the above filter is broadly from 7 sectors. This is why in Basic Characteristics of a Good Business/Industry Part 1 we wrote “Profits are clustered”.

So these are the companies/ Industries which have historically generated good returns with growth. (Check our post under Valuation series here where we have explained why a combination of high ROCE and growth matters for high returns).

Ps: As these data points are downloaded from screener there might be some inconsistency in some of the data points like for example we observed there is no name of Shree cement. Also you would see no banking name here as for banking ROCE's are pretty low and leverage being kind of raw material in such business these businesses are evaluated based on ROEs'. So instead of ROCE if we had put filter of ROE good banking names would have propped up.

Also, apart from clustering explained above the data can also be used to find outliers, as if a single company is coming into filter from the entire industry it truly is standing out and will pique interest of all the shareholders seeking an exposure to that industry - as investable candidate as rare in that industry. See the example of Relaxo footwear one of the 123 companies in the filter- The sole candidate coming from the footwear industry in this list.

Also second angle is sometime overall an industry might have very low representation in the overall basket. For example check Life insurance - as an industry just two companies out of 123 are life insurance companies. But when you go and check total number of listed companies in Life insurance industry there are only 3 companies - this basically states that 67% of the listed basked of Indian life insurance players have been good compounding stories.

Now taking this a step further.

As you know “All Great Businesses are not Great Investment”. No matter how much a company earns in terms of profits/cash flows we as investors should always be interested in key question i.e. “Has the investment also provided real returns to shareholders in terms of market cap appreciation?”

So we decided to add 1 more filter to the above filters which is Average 10 year stock CAGR more than 20%. Now the set of filters became:

Sales growth last 10 years > 10%

Average ROCE of 10 years > 20% and

Market capitalization > 500 crores because we wanted to avoid small companies in that list.

10 year Stock CAGR > 20%

Out of 123 companies 79 companies were able to generate 20% + CAGR for their shareholders which means an outstanding strike rate of 64% (79/123).

List as on 23-Feb-2022:

We were also curious to understand that although 64% of the companies have generated great returns how many at least generated return more than Cost of capital?

For understanding that we ran a separate set of filter of

Sales growth last 10 years > 10%

Average ROCE of 10 years > 20% and

Market capitalization > 500 crores because we wanted to avoid small companies in that list.

Average 10 year stock CAGR > 12.5%

Out of 123 companies 93 companies were able to generate 12.5% + CAGR for their shareholders which means an outstanding strike rate of 75% (93/123).

A Brief summary:

Total companies with good track record: 123

Out of these beating cost of capital: 93

Out of these companies beating cost of capital (i.e. 12.5%) but generating lower than 20% CAGR: 14

Out of these generating >20% CAGR: 79

So above was the case that applying few quality filters can definitely provide investments with high strike rate of beating cost of capital.

Now, lets invert the question does only businesses which come under above filters generate good market beating returns of 20%+ CAGE over long term. The answer is a straight No!!!

Below is the total list of companies which have generated 20%+CAGR in past the decade:

620 companies out of 4789 listed companies has generated 20% + CAGR over past decade.

This 620 companies contains 79 quality businesses which we filtered out previously which means out of 620 companies approximately only 13% of companies only were standard quality companies in the list.

So, first settle this debate of why some section of investing community consistently talks only about investing in quality companies Vs some section of investment community disregards it. According to us the real debate is whether buying ONLY quality companies is a guaranteed source of generating above average market returns?

HUL: 6 Years of consoliation

Infosys: 16 Year only approx 3.5-4x

Castrol India: 6-7 years of Negative return & 11-12 years of very narrow consolidation (in 100-150% return range)

Being in the right segment of the markets in terms of good business and industries is definitely important, especially when you are fresh in markets just learning the ropes of investing, because if you start analyzing a company/industry whose returns are consistently below Nifty-50’s 10 year rolling return then there is a high chance that you are playing a turnaround/cyclical business and to successfully play turnaround/cyclical opportunities skillsets like position sizing, risk management, exit points/triggers play a bigger role as compared to just fundamental analysis and all the above mentioned skillsets are generally obtained over long period of continuous investing practice and not just part-time tracking the market as a hobby.

Hence, there can be a high chance of economic losses for a fresher directly starting his career with turnaround/cyclical stories. The scenario is completely different if you are working under an experienced fund manager and under his tutelage you are playing turnaround/cyclicals as than you have experience on your side. But don't play this game alone especially at the start of your career.

We also need to understand there are outliers in every arena, there are PSUs which are hugely profitable, there are periods where even sugar businesses have provided tremendous results.

Look at Balrampur Chini

Look at this Excerpt from a great Memo on PSU published by EA sir

(a) 1999-2021 (Long term performance): PSU Index: 10.42% CAGR Vs S&P BSE 200 Index: 14.43%

(b) 1999-2011 (Period when PSU shares did well): PSU Index: 22.01% CAGR Vs S&P BSE 200 Index: 17.85%

(c) 2011-2020 (Period when PSU shares did terribly): PSU Index: -7.58% CAGR Vs S&P BSE 200 Index: 4.82%. Specifically periods of April 2014 to May 2021 were very bad for PSUs.

(d) 2020-2021 (Last year, when PSU shares are slowly regaining their acceptance levels): However, the market is nothing if not a living proof of the principle of reversal to the mean. PSU Index: 54.95% CAGR Vs S&P BSE 200 Index: 58.68%"

Read full here: https://www.finnacleshahclasses.com/forum/research-paper-investor-memo/o3-securities-is-hatred-towards-psus-justified-june-21

Even buying junk makes a killing in a sector rally as a general pattern is that when a sector starts moving first the quality companies moves and than quality consolidates and it again moves. After this second move the growth drivers are explicit for the market to see for the sector BUT the valuation gap between historically poorly managed business (Junk) and quality companies widens to great level. This Valuation gap combined with improvement in fundamentals happening due to sectoral tailwind creates a perfect environment that leads to capital rotation into junk stocks leading to ferocious rally in such counters.

Hence, we need to adapt slowly and steadily with different investment practices of capital market rather than getting excited by one investment philosophy. Never enter in a debate. In markets as per our limited experience every type of investment philosophy makes money if we stick with basic principles of investing consistently and every strategy that is out of flavor today will return back and every strategy that is darling of today's market will time consolidate or correct.

To conclude, having a high quality business filtered approach is just one form on generating investment ideas and being a fresher/beginner it might pay more to stick with businesses where historical probability of generating decent returns is higher and you don’t need to jump in and out of investments due to inability to handle volatility.

In fact more than generation of investment idea this filtering approach can be used to track a universe of stocks and when you find some catalyst/outlier moment among the basket stocks (123 companies as of today) you can pick up those companies and start studying them in detail. Some examples of catalyst are as below:

a)bumper quarterly results

b) increase in margins

c) order book/sales growth kicking in greater than historical average

d) Capex plans of reasonable size 10% of current fixed asset & above being announced

e) Promoter/insider buying from especially from open markets of reasonable size (promoter stake increasing by 1-5%)

f) Some major government reform happening in a particular sector

g) Some renowned investor entering the stock

h) All time high moves combined with high volumes and high delivery percentage especially if across a particular industry or frequent all time high in a stock after a long period of consolidation

i) All the stocks from a particular industry getting hammered or available at decadal low margins/growth

j) Sudden positive change in management commentary regarding growth outlook

k) Surge in M&A deals, open offer in a particular industry at high valuations

L) De-merger of loss making/low margin business

Readings:

2 - https://marcellus.in/blogs/indias-top-20-leviathans-awe-inspiring-dominance/

3 - https://marcellus.in/blogs/small-data-is-more-important-than-big-data/

4 - https://marcellus.in/blogs/marcellus-crushing-risk-is-more-rewarding-than-chasing-returns/

5 - http://stalwartvalue.com/only-2-5-of-8000-listed-indian-stocks-are-investable-heres-the-list/